Insight Paper February 1, 2024

Retail Healthcare

A shifting landscape.

Retail clinics are becoming increasingly prevalent in the healthcare sector, offering consumers convenient, cost-effective, and easily accessible services. Typically situated in retail settings like supermarkets, major retail stores, and pharmacies these clinics have gained significance as additional entry points for patient care, particularly emphasized by the impact of COVID-19 and the widespread adoption of telehealth. The retail clinic market, which stood at $2.05 billion last year, is expected to reach $4.22 billion by the year 20291. This overview will cover various aspects of retail clinics, including market share, health equity, data analysis, artificial intelligence, staffing, oversight physicians, and future expansion, including telehealth options.

MARKET SHARE

Factors such as location, the range of services provided, and the quality of care play a crucial role in shaping market share. The retail clinic sector has demonstrated consistent growth in the last decade, with these clinics experiencing heightened customer visits and increased sales as individuals integrate healthcare services into their routine shopping activities. The incorporation of clinics and services by retailers is often motivated by the desire to enhance overall profitability and loyalty. During their visit, patients are inclined to fulfill prescriptions or make additional purchases, whether related to their healthcare visit or not, thereby contributing to the retailer’s overall financial performance and brand awareness.

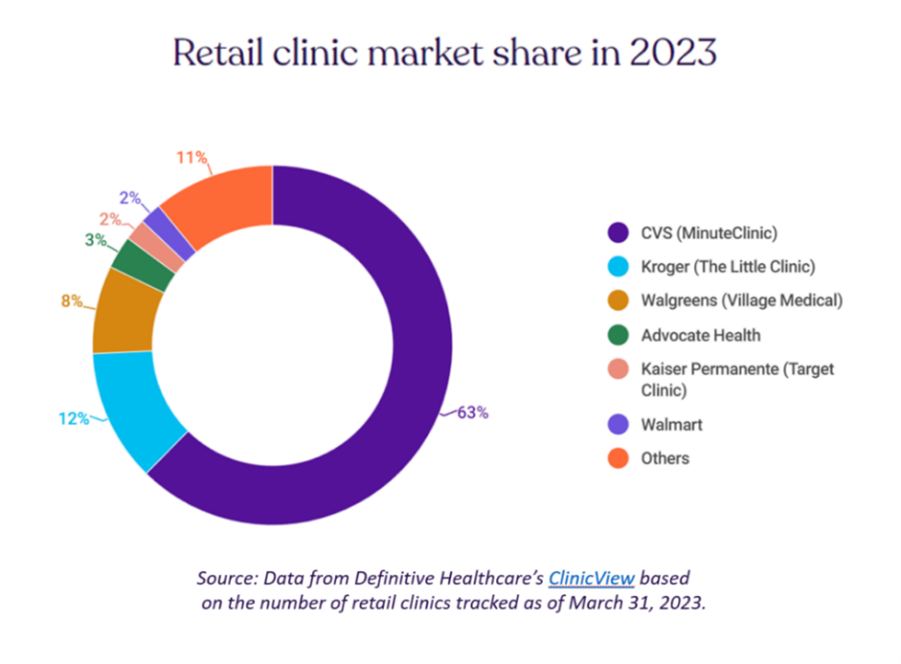

As of early 2023, there were over 1,800 operational retail clinics spanning 44 states2. Most of these clinics are under the ownership of major retail chains, with CVS Health’s MinuteClinic holding a substantial 63% of the market share. Other notable contributors include Kroger’s The Little Clinic, accounting for 12%, and Walgreens’ co-owned Village Medical, making up 8% of the retail clinic share3. CVS is additionally venturing into chronic disease management through their HealthHUBs, aiming to address a broader patient population. However, these current trends will be affected by the growing expectation that the retail health clinic market is predicted to double by 20274.

HEALTH EQUITY

Retail clinics hold the potential to enhance health equity by expanding the availability of fundamental healthcare services in underserved regions. They provide a convenient healthcare alternative for individuals encountering obstacles to traditional healthcare, such as prolonged wait times or limited transportation options.

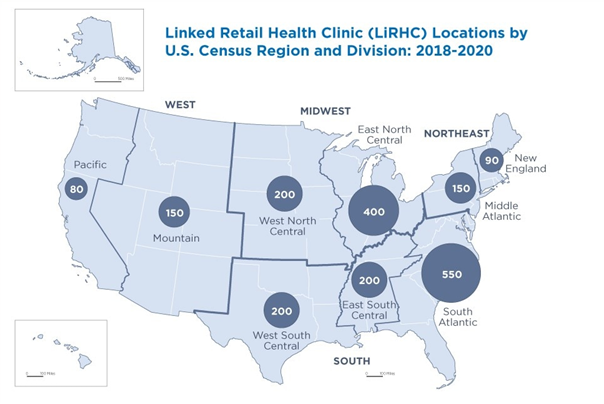

However, concerns have been expressed regarding the possibility that retail clinics might unintentionally contribute to health disparities if they fail to adequately cater to disadvantaged populations. Additionally, a notable challenge is the fact that over 97% of all retail health clinics are situated in metropolitan areas of the United States, which is defined as a city with a population of at least 50,000 residents5. Given the business structure of retail health clinics, it does make logical sense that these clinics are primarily located in heavily populated areas, however this creates further health disparity for residents of lower-populated areas of the United States. The illustration below breaks down the geographical division of retail health clinics by region6.

From a health systems perspective, owning or collaborating with retail care facilities offers two primary advantages: improving access to care and meeting consumer demand. Thus, underscoring the role retail care plays in addressing unmet patient needs. A recent study revealed that while consumers express openness to utilizing retail clinics, the actual utilization is often lower than anticipated. Utilization patterns are influenced by factors such as race and location, with individuals of color and those in urban areas demonstrating the highest utilization rates7.

DATA ANALYTICS

Retail clinics collect data on patient encounters and outcomes for analytical purposes, with the intent to help improve the quality of care and efficiency of these clinics. Data can also be used to identify trends and patient needs, allowing for more targeted services and interventions. However, the continued challenge of integrating electronic medical records across systems is a barrier. Although the retail clinic may allow for a more convenient location and timing for patient care, the continuity of the patient’s care, and their electronic health record may be compromised or limit full accessibility. Healthcare systems still do not have an efficient manner to share medical information due to interoperability issues and myriad different electronic health record systems.

ARTIFICIAL INTELLIGENCE

Artificial intelligence (AI) is increasingly being used in healthcare, including retail clinics. AI can assist with patient triage, appointment scheduling, including decision support for clinicians. This technology can help clinics streamline operations, reduce administrative overhead, and enhance the patient’s experience.

Two retail clinics in Phoenix are pioneering the use of AI diagnosis for certain conditions. The patient is instructed to obtain key information including images which are then analyzed via AI algorithms, and results are sent to a physician. The healthcare physician then consults with the patient for diagnosis and treatment options8.

STAFFING

Staff commonly consist of nurse practitioners (NPs), physician assistants (PAs), commonly referred to as advanced practice providers (APPs) capable of diagnosing and addressing common, non-life-threatening conditions in retail clinics. These clinicians possess licenses that authorize them to deliver various primary care services, ranging from administering vaccinations and handling minor wound care to overseeing chronic conditions such as diabetes. Their training and proficiency make them well-equipped to provide primary care services in a retail clinic.

OVERSIGHT PHYSICIANS

Retail clinics typically function under the supervision of collaborating physicians who bear the responsibility of offering guidance, support, and expertise to the nurse practitioners (NPs) and physician assistants (PAs) employed in these clinics. Physicians play a pivotal role in maintaining the standard of care and can engage in consultations with clinic staff when needed, although their physical presence at the retail clinic is not always required. This may be an opportunity for a local health system to partner with a retail chain.

REGULATORY CONSIDERATIONS

The future expansion of the healthcare service will hinge on regulatory policies that impact the healthcare environment. Striking a balance between federal and state regulations is crucial. Evaluation and monitoring programs are being implemented by federal and state governments, as well as industry groups, to advance quality standards for nontraditional healthcare operators, like retail health clinics9. The meticulous consideration of state regulatory particulars encompasses aspects such as practitioners, oversight physicians, pricing, operating hours, services (including the dispensing of pharmacy medications), and billing.

TELEHEALTH, FUTURE EXPANSION, AND DISRUPTORS

The future of retail clinics is a matter of finding the best “crystal ball” and planning (betting?) on what consumers will jump on for new healthcare access. An easy area for planning is the continued expansion and integration of telehealth options. Telehealth allows patients to access care remotely, and many retail clinic operators have recognized the potential of offering both in-person and virtual services. This hybrid approach can extend their reach and provide care to a wider range of patients, including those in rural areas. The convenience of telehealth can also attract tech-savvy consumers. Some studies have illustrated that a telehealth visit will yield an in-person visit within a few weeks of the initial telehealth visit.

Costco recently entered the retail healthcare space with its partnership with Sesame. The offerings will include virtual primary care visits, virtual health check-ups, and virtual mental health visits at affordable costs. Sesame does not accept insurance so the visits will be out-of-pocket expenses for the patient. Other retail giants like Amazon and Best Buy are also jumping into retail healthcare. Amazon opened the virtual visit space to all states in 2023 and Best Buy continues to focus more on the aging population for its healthcare market share. Best Buy will send a member of their Geek Squad to an older person’s residence to ensure connectivity, but they do not engage in any healthcare activities in person. Finally, QuikTrip, a gas station company, started its own urgent care company called MedWise in the Tulsa area. They have 12 locations (not in gas stations) strategically placed across the city.

Retail clinics are beginning to offer additional specialized services, such as mental health support and chronic disease management, to meet evolving healthcare needs. Examples include the forementioned CVS HealthHUBs for chronic disease management and Costco’s virtual mental health visits. Other retail clinics are adding basic lab and radiology services. This allows for greater diagnosis options and patient connection to their providers.

Collaborations with local healthcare providers and community organizations can further enhance the role of retail clinics in addressing health equity. This ranges from Target Clinics and Kaiser Permanente in California (34 locations), CVS partnering with almost 50 providers across their market, and Walmart recently partnering with Orlando Health in Florida.

Greater use of AI and data analysis will improve the quality and efficiency of care delivery at retail clinics. Analysis and “prediction” of the extra purchases tied to clinic visits include over-the-counter medications, prescriptions, durable medical equipment (splints, wraps, crutches, etc.) along with food and clothing purchases too. The retail basket is a large driver in not only determining where the retail giants will expand, it is also a large driver of the clinics’ success.

From survey findings from NEJM Catalyst Insight Council members published in October 202210, despite the growth of retail health clinics, only 15% of respondents own or have a formal relationship with these outlets; another 10% say their organization is planning an affiliation within the next three years.

And in terms of what they view as the greatest outside competitive threat to traditional healthcare institutions, more than half the respondents (56%) cited direct-to-consumer telemedicine by a wide margin versus 16% for retail clinics and 13% for urgent care clinics.

Four potential options for working with retails clinics or setting their own course of new ventures are:

- Partner and coexist with retail care.

- Expand primary care access and new modes of delivering treatment.

- Uberize care with GPS-enabled smartphones and intelligent navigation to match immediate demand to care coordination.

- Consider focusing on in-home care – the return to house calls?

In summary, retail clinics are gaining market share, playing a significant role in providing accessible primary care services, and can enhance health equity. Data analysis and AI will continue to drive improvements in care quality and efficiency. The future of retail clinics will likely involve a combination of in-person and telehealth services, making healthcare even more accessible and convenient for patients.

For further insight and information, contact us. We’re happy to share our expertise with you.

References

https://www.healthcarefinancenews.com/news/retail-clinics-seeing-utilization-soar-popularity-grow

https://www.census.gov/library/stories/2023/03/retail-health-clinics-near-you.html

https://www.census.gov/library/stories/2023/03/retail-health-clinics-near-you.html

https://www2.deloitte.com/us/en/insights/industry/health-care/alternative-sites-of-care.html