Insight Paper October 9, 2019

The Weaponizing of Geopolitics Within the Lending Market

The branding and credibility of financial institutions are put to the test as global events and news digestion circulates more efficiently and aggressively through an inter-connected community of criticism.

With the advent and promulgation of social media’s continuing influence on both a societal and global policy level, financial institutions are continuously inundated with information requests and public pressure to disclose their various operational tactics and intimate details surrounding their most prestigious clientele. There has always existed this circle of besieging by the general public and others. Distrust of banks and, more specifically, the lending operational arms of financial institutions continues to depreciate rapidly. Generalizations include the assumption the lender only cares about the interest rate or the ability of the receiver to pay in full. Little attention is given to the purpose of the loan or the moral/ethical standing. Regardless of one’s hostility towards the general process, one clear trend has remained present for centuries: politics plays an influential role in banking.

When we speak of politics or the interference of politics, we are not referring to individual political parties, such as the Republicans and Democrats in the U.S. or the Tories and Liberals in the UK. In almost all cases, we are referring really to diplomacy and, more importantly, international commerce and banking’s absolution to international governance and vice versa. For many financial institutions, divisions are often delegated the responsibility of government relations (i.e. lobbying), regulatory practice and oversight, and transparency or disclosure strategy. There are multiple examples where the bank’s hand is forced to “open the books” or provide guidance on why a loan was offered and what the terms included. Regardless of your position on the openness of these discretions, banks have a primary fiduciary responsibility to their clients – both in protecting and preserving their wealth/assets. When a public sector entity or state actor is involved, the dilemma becomes increasingly complex and fragile. Public officials are often held to certain standards while lending practices and receipt are, even more so, scrutinized further. This becomes incredibly complicated, especially when you have multi-national entities at play that report not only to a board of directors but may be beholden to certain sovereign governments.

While the legal and regulatory elements of the lending market are often difficult waters to navigate, the public relations and reputational elements are often increasingly manageable. Today, there are considerable resources and platforms that can help your institution to analyze and defend a hostile assault on your organization’s lending practices. To better understand how geopolitics plays a pivotal role in lending frameworks, we can take a sample list of events that speak volumes to the criticality of this topic. By reading case studies, such as these, your organization can more proactively prepare to deflect hostile media and public pressure. The objective of the financial institution is to mitigate as much pressure as possible while still upholding your client’s privacy and trust. In cases where extreme pressure is placed, financial institutions sometimes resolve to give in. This not only caves to public pressure but destroys the trust building relationship you have with current and prospective clients. By analyzing examples of hostile or glorified loan operations and activities, you will better position your institution to competitively react to geopolitical turmoil and change.

Example Case Studies & Media Pieces

ASIAN INFRASTRUCTURE INVESTMENT BANK STRENGTHENS CHINA’S REACH1

With the creation of a lending operational bank through China’s State government, few countries are able to compete with the massive, politically tailored lending arm of the Communist nation. Heavy loans are continually pumped into developing territories, in particular South America and areas of Africa. These loaning practices have empowered the Chinese government with the ability to influence local elections and job growth in nations that typically possess low sustainable infrastructure. In addition, the utilization of financial loans for purposes of infrastructure development have considerable supplemental advantages, such as improving diplomatic relations and spreading cultural influence.

U.S. PRESIDENT’S BUSINESS DEBT TO DEUTSCHE BANK2

Many high-net worth individuals and personal brands often extend their wealth through multiple, various avenues. For example, celebrities and industry billionaires often store their wealth in real estate or charitable foundations (that may or may not bear their name). In many cases, high-net worth personal banking can often lead to loans. Deutsche Bank’s relationship with the 45th President of the United States is a solid example of political/external pressure on revealing lending practices. Although the President has had a long-standing business relationship with the German Deutsche Bank which has financed many of his real estate empire ventures, political opponents are pressuring the financial institution to reveal the loan agreements and stipulations.

CHINESE RENEGOTIATION OF LOANS IN DEVELOPING WORLD3

As with personal loans and debt, the cost or associated number plays a pivotal role in one’s ability to make rational/irrational decisions. In many cases, the loan amount may warrant such considerably high interest, that the principal grows, instead of declines, as payments are siphoned. The Chinese government often use the procedure and terms attached within a loan to enact influence in other areas. In recent years, we have seen a movement of renegotiation for massive, capital loans to developing nation governments. Some of the newer terms are forgiving, while others (by some experts’ opinions) are punishing in nature. Regardless, the force of will and strength associated with the lending power’s influence is substantial and can have altering impact on the stability of the government or local economy.

NIGERIAN ECONOMY BEHOLDEN TO LENDING LAWS4

African nations are not unique in this perspective. Ultimately, softening or relaxing loan acceptance and credit limit criteria is often utilized as a strategy to inject economic development and investment into local (or national) economies. In the case of Nigeria, the government has begun expanding the propensity of loans to individuals and business with little threshold command. Though the practice is sound in execution, how the aftershocks will trickle is somewhat resonating to the overall theory. Will the new lending practices catapult the economy or crush a debt-ridden society?

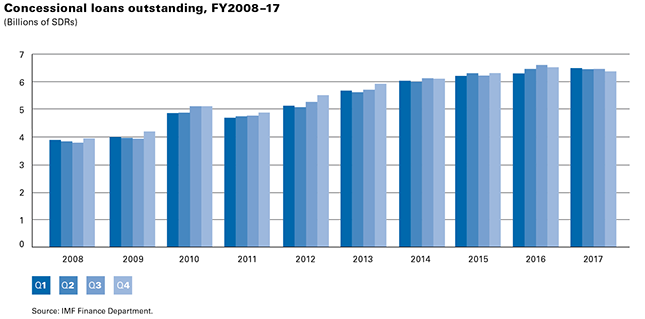

INTERNATIONAL MONETARY FUND ENACTS BIAS LOAN SELECTIVENESS5

The World Bank and the IMF are notorious for their immense financial reach through the use of massive developmental loans to nation state entities. Throughout the last decades, the two banks have secured significant political and monetary traction by influencing a country’s rise through the influence of its loan servicing programs. In particular, the institutions are able to set heavily partisan standards/guidelines attached with each loan to better influence economic mobility and systematic change. In the case of the IMF, multiple studies have been conducted showing specific loan procedural bias towards specific geographical territories allowing for a division of global economic fruition.

U.S. BANKS SUPPLEMENT DRUG CARTEL FINANCIAL OPERATIONS6

In most cases, large financial institutions are extraordinarily unaware of the immense paper trail left behind in a financial transaction. They may manage Part A of the loan but the path to Part Z is a trail of misdirection and distraction. For years, the Drug Enforcement Administration and the U.S. Treasury have found significant evidence of American banks inadvertently supporting South American drug cartel operations. Whether it be wire transfers or loan processing, the shady dealings of this underworld are significantly propped up by the prolific lending habits of large banks. This is one area of loan processing where financial crimes and anti-money laundering (AML) services/consulting can have an impact.

With some of the examples we have covered, it is clear the immense influence that an institution’s lending arm will have on sociopolitical and geopolitical plateaus. Over time, institutions have sometimes failed to adapt appropriately leading to immense public backlash over poorly handled loan and financing disclosures. Ultimately, it is this shifting weight game, wherein the bank or financial entity must hold strong in their resolve to maintain customer privacy while also abating public fury or the convenient government/judicial regulatory reach. However, financial institutions can prepare for the onslaught by implementing several key strategies and methods to better manage the intricacies and intimacies of loan financing. In many ways, larger banks already have the resources aligned and only require the strategy or call to arms necessary to protect their reputation and instill an operational response approach. Smaller institutions, in many cases, are unaffected by this discourse, as nation states and high-net worth individuals, must always turn to places of immense resource and expertise.

Regardless, here are some critical actions/procedures that will help your institution bear the lending spotlight:

- Employ a team of expertly crafted public relations and investor relations personnel to manage social media, public discourse, and public sector oversight

- Draft hypothetical mitigation scenarios to react or alleviate loan servicing hostility

- Employ crisis communications teams or external consultants to assist in the verbiage architecture of formal responses and/or provide remediation strategies

- Train internal communications teams to measure your employee base reaction and morale during ongoing media or public discourse conversations covering your institution’s activities

- Confirm you have the appropriate resourcing and budgetary guidelines set forth to properly execute operations in money laundering, miscellaneous financial crimes, loan fabrication or fraudulation, forensics, and regulatory/compliance management

- Ensure that your governmental relations and legal division have the insight and expertise needed to interact and assist diplomatic or cross-national inquiries and possible political fallout

- Employ teams of marketing information specialists that can highlight and dissect areas of customer capture and retention post-crisis, including brand reputation management

- Train loan servicing officers in the art and intuition of loan application scrutinization and the ability to detect abnormalities

- Instill leadership and executive discipline in promoting and executing bipartisan and unbiased loan procedural best practices

The role a financial institution can assume in loan transactioning is one of immense influence and power. Over time, banks have had critical and insurmountable impact on corporations, governments, and high-net worth individual’s abilities to surpass their net worth and commit to actionable modes of investment. In many ways, loan servicing is a realm of finance that should be continually explored because of its capacity to endure and promote significant economic progress which, in turn, has the possibility of a trickle-down impact to job growth, infrastructure development, and overall cost of living situations. Additionally, there are several areas of exploration within the lending space that have emerged in recent decades – many in the FinTech environment. Micro lending, auto-approval, market research, data science, and cybersecurity are just some examples of the extensive improvements and tools currently at work in reshaping the existing lending environment789. Ultimately, the power that comes along with loan management should not be limited to any one single individual but a collaborative enterprise with assurances and safeguards to breed caution.

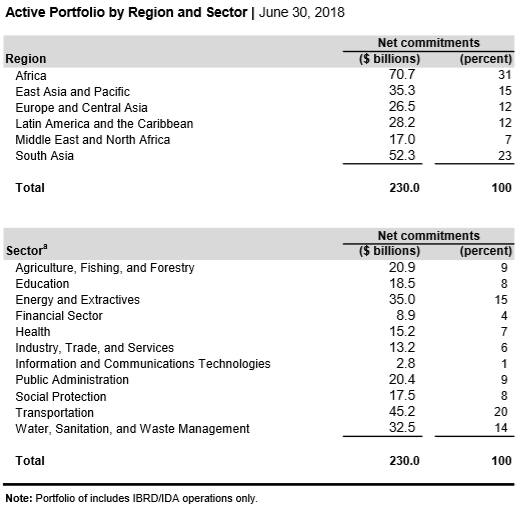

World Bank Lending Distribution in 2018 for the Following Programs:

International Bank for Reconstruction and Development and International Development Association

[1] https://www.theguardian.com/world/2011/apr/03/us-bank-mexico-drug-gangs

[2] https://www.inc.com/james-paine/10-companies-using-technology-to-disrupt-the-lendi.html

[3] https://www.accenture.com/_acnmedia/pdf-68/accenture-where-fintech-lending-will-land.pdf#zoom=50

[4] https://www.pwc.com/id/en/industry-sectors/financial-services/fintech-lending.html

[5] https://www.bloomberg.com/news/articles/2019-10-01/nigeria-ups-the-ante-against-banks-with-tougher-lending-demands

[6] https://www.researchgate.net/publication/23525650_IMF_lending_and_geopolitics

[7] https://www.geopoliticalmonitor.com/geopolitics-and-the-asian-infrastructure-investment-bank/

[8] https://www.ft.com/content/8c6d9dca-882c-11e7-bf50-e1c239b45787

[9] https://www.ft.com/content/0b207552-6977-11e9-80c7-60ee53e6681d