Let us help you "Get to Done"

We’ve been in your shoes. Let us help you find a better way.

Case Study

September 22, 2022

Case Study

September 22, 2022

Mergers & Acquisitions | Program Execution | Strategy Execution

Helping a small gene therapy provider navigate through being acquired by a large, multi-national pharmaceutical firm.

Insight Paper

August 25, 2020

Insight Paper

August 25, 2020

Mergers & Acquisitions | Technology

Glenn Kapetansky and Joe Oliva share their thoughts on conducting IT due diligence during the M&A process.

Event Summary

December 30, 2019

Event Summary

December 30, 2019

Mergers & Acquisitions | Strategy & Innovation

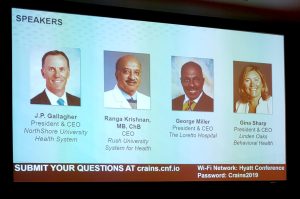

Trexin’s Brian Weber and Aviva Clayman recap the lively discussions at this year’s Crain’s Chicago Hospital CEO Breakfast.

Insight Paper

April 3, 2019

Insight Paper

April 3, 2019

Digital Transformation | Execution & Recovery | Growth & Acceleration | Mergers & Acquisitions | Optimized Operations | Program Execution | Strategy & Innovation

Change is a critical component of an organization’s ability to adapt and compete. In order to correctly implement change, Joe...

Video

January 4, 2019

Video

January 4, 2019

Digital Transformation | Execution & Recovery | Growth & Acceleration | Mergers & Acquisitions | Optimized Operations | Strategy & Innovation | Strategy Execution

Learn more on how Trexin can help you create an actionable, stepwise plan to improve the capabilities necessary to achieve...

Case Study

October 25, 2017

Case Study

October 25, 2017

Analytics | Mergers & Acquisitions | Program Execution

Trexin was asked to help assess and prepare a strategy and roadmap for a resilient set of acquisition-ready, technology-enabled business...

Case Study

March 1, 2016

Case Study

March 1, 2016

Mergers & Acquisitions | Program Execution

After carving out a $100M 3PL(third-party logistics provider)/transportation logistics and inventory supply chain management business from a $3.6B moving and...