Case Study November 9, 2015

Maximizing ACA 3R Payments for a Healthcare Startup

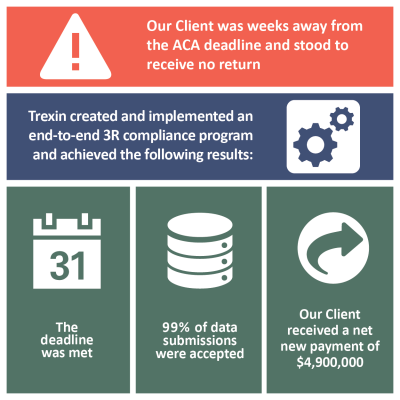

Trexin led a last-minute effort for a new Healthcare Consumer-Oriented and Operated Plan to validate its Risk Adjustment and Reinsurance submissions that directly resulted in a net new payment of $4,900,000 on a project investment of less than $100,000.

Business Driver

An innovative Healthcare Consumer-Oriented and Operated Plan (CO-OP) established under the authority of the Affordable Care Act (ACA) was weeks away from the deadline to submit their data to the Centers for Medicare and Medicaid Services (CMS), yet they did not yet have a program in place to validate and optimize their Reinsurance and Risk Adjustment data submissions. The CIO asked Trexin to lead three main initiatives:

- Prepare the organization for compliance with the CMS “3R” Program (for Reinsurance, Risk Adjustment, and Risk Corridors) instituted as a part of the ACA.

- Correct data quality defects and identify gaps in data that would affect Reinsurance payments and Risk Adjustment penalties.

- Manage critical dependencies on external sources of data and vendors.

Approach

Trexin’s team immediately began working closely with internal and external subject matter experts to diagnose suspected problems and identify missed opportunities with EDGE server enrollment, medical claim, and pharmacy claim files.

Our team quickly determined the root causes and suggested corrections for the most significant data issues. We then analyzed and corrected errors in the EDGE server submission data. And throughout the process, Trexin managed the working relationships with external data partners and the third-party administrator point-of-processing vendor our Client had recently appointed.

Results

When Trexin was first engaged in this process, our Client was well behind schedule, their risk score was zero, and they would have received no 3R payment. With our help, not only did they meet the ACA deadline, the acceptance rate of the data submitted was well over 99%, and our Client received payments in excess of $4.5M for Reinsurance and a net of over $400K in Risk Adjustment transfer monies on a project investment of less than $100K.

Once our work was complete, we provided additional training and mentoring, and our Client now possesses a fully-documented and proven end-to-end 3R compliance program.