Insight Paper June 28, 2023

Federal Carbon Neutrality Goals and Your Business’s Organizational Maturity

The Biden administration’s proposed rule change for Federal contractors represents one of the most significant changes to Federal ESG policy in the last decade.

This article is the third of a multi-part series where Trexin will be diving into Environmental, Social, & Governance (ESG), as we seek to explain the trend, how it benefits businesses, and how Trexin can help your business succeed with it. If you wish to see our first Trexin Insight Paper (TIP) where we explain the benefits of ESG, please click here.

Governments across the globe are increasing their commitment to meet climate goals to reduce carbon emissions, including the U.S., where the government has historically pursued a more laissez-faire stance than many governments in Europe and East Asia. Perhaps the most notable sign of this change in approach is the Biden administration’s proposed rule change to the Federal Acquisition Regulatory Council. The proposed rule change is known as the Federal Supplier Climate Risks and Resilience Rule and has left many business leaders wondering how their organization will be affected. Ultimately this policy serves as a way to apply soft power to address carbon emissions than the direct reductions brought about by a hard regulatory rule; but the reporting and goal-making requirements within it will serve to force large government contractors to create early stage ESG programs.

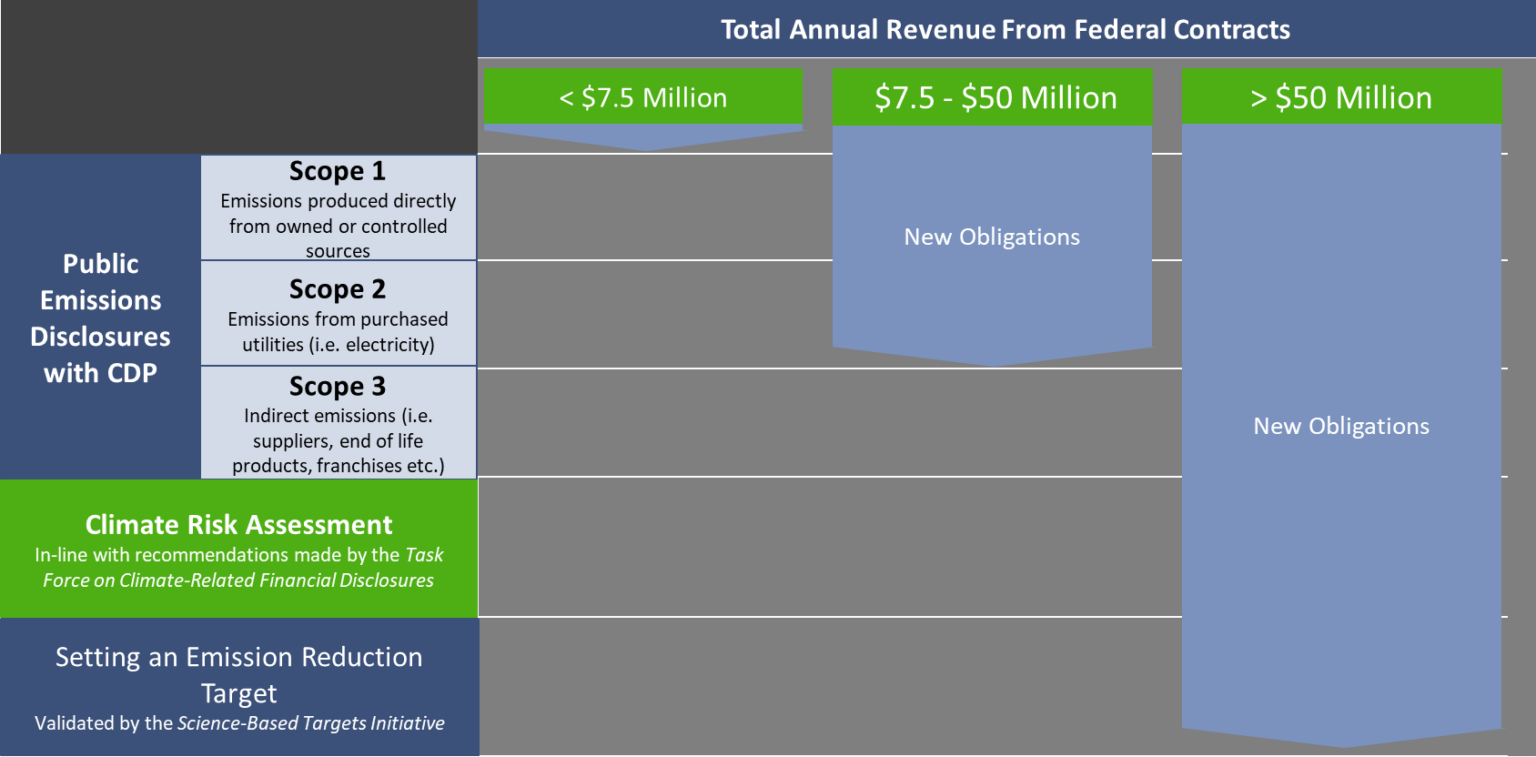

To start, let’s first go over what the proposed rule changes of the Federal Supplier Climate Risks and Resilience Rule entail. The Federal Supplier Climate Risks and Resilience Rule consists of three separate parts, which are as follows:

- Public greenhouse gas emission disclosures with a non-profit known as Carbon Disclosure Project (CDP)

- Climate Risk Assessment in-line with the recommendations made by the Task Force on Climate-Related Financial Disclosures

- Setting an emissions reduction target validated by the Science-Based Targets Initiative (SBTi)

How these three parts are applied varies depending on the total monetary value in federal contracts a given company has. Companies with less than $7.5 million in annual contracts are unaffected, those with greater than $50 million must complete all three parts, and finally companies between those above two points must complete a portion of part 1.

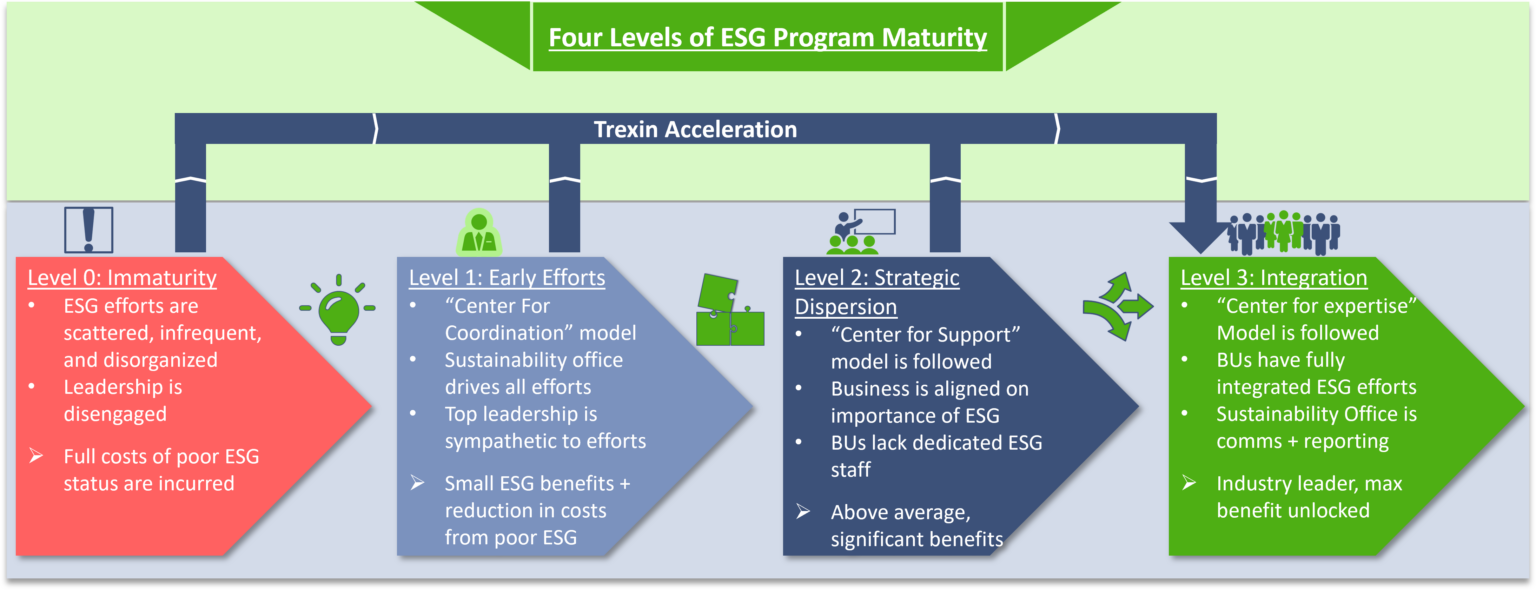

When diving into these requirements it is easy to see that they are not intended to reduce emissions through direct means, after all there is no enforcement mechanism for missed goals. However, these measures will force businesses to create a centralized ESG program: to analyze the company’s ESG performance and create goals that can meet the SBTi’s criteria. Looking back to our previous TIP on ESG organizational maturity models, we can see that the first major step along a company’s ESG journey is often creating a centralized ESG program that operates as a Center for Coordination. Outside of considerations related to the general electorate, it is evident that the main purpose of these proposed rule changes is to drive this change, and thus begin bringing ESG to the forefront of business leader’s minds. Nudging them to create the tools they need to start enacting change in their businesses, and acting as a warning that further changes may be forthcoming in the future.

Creating a functional ESG program that can accurately report and coordinate across a business is not an easy task, it is arguably harder than meeting a flat emissions target. For many companies, significant business transformation will be required to meet the requirements of the Federal Supplier Climate Risks and Resilience Rule. If you or your company would like help with ESG efforts, please reach out to our Advisors at Trexin here.