Insight Paper April 27, 2023

ESG Strategy Goals: Business Transformation & Overall ESG Organizational Maturity

Reaching the correct organizational structure to drive ESG organizational maturity is key to unlocking long-term value.

This article is the second of a multi-part series where Trexin will be diving into Environmental, Social, & Governance (ESG), as we seek to explain the trend, how it benefits businesses, and how Trexin can help your business succeed with it. If you wish to see our first Trexin Insight Paper (TIP) where we explain the benefits of ESG, please click here.

As we discussed in our previous TIP, ESG efforts present a high value proposition for businesses; however, as always, once the decision has been made to pursue ESG efforts, the true difficulty lies in unlocking that value. One of the biggest struggles is in deciding what a company’s true goal is, all too often when companies come up with sustainability goals for their ESG efforts they focus on a single measure of impact such as “reduce emissions by 15%”, or “use 20% less electricity”. Unfortunately, one-off goals such as the above provide little in the way of driving long-term improvement or unlocking significant benefits for the company if efforts aren’t continued after the initial goal is reached. If a company wants to truly maximize its ESG effectiveness, and the financial benefits that effectiveness unlocks, then it needs to create a system allowing for continuous improvement. This continuous improvement requires business transformation to reach a high level of ESG organizational maturity. Or put more directly, the creation and maintenance of an org structure and culture for a high performing ESG program continuously creating, prioritizing, and executing high-value ESG initiatives and projects.

Before we dive deeper into the details, it is important to touch on the significance of two things:

1. The impact of achieving success from an organizational standpoint

2. Continuous improvement

Organizing their company in a way that allows it to achieve success is one of the most overlooked and frequently undervalued responsibilities that executives face. An ironic fact, given it is also one of the most impactful things executives do for their company. Companies that reach the level of organizational success where they are aligned, capable of executing strategy, effective at decision-making, adaptable, efficient, and engaged to go the extra mile significantly outperform companies that are not; these organizations are five times more likely to be in the top quintile for performance based on revenue growth, profitability, and shareholder returns than companies who meet none of the criteria for having reached organizational success1.

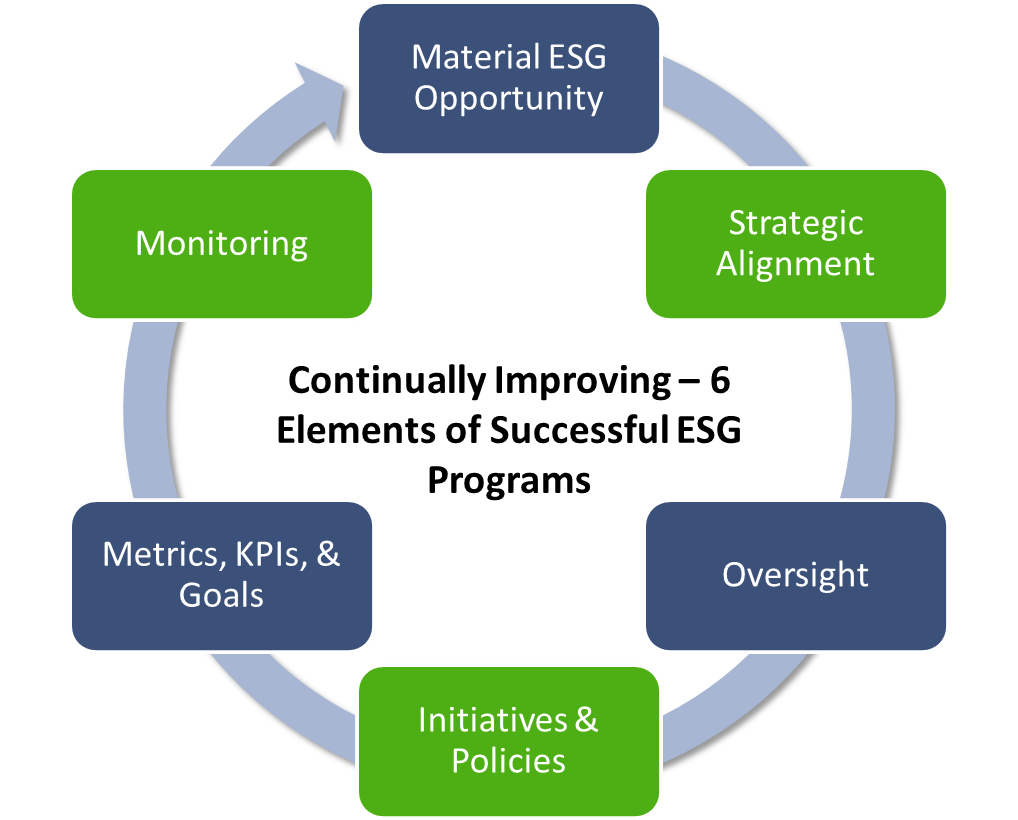

Out of the myriad of reasons for this effect, perhaps the biggest, is that it allows for continuous improvement. Just like it sounds, continuous improvement is arguably the holy grail for a company to reach, an organization which can make itself better and better with little guidance from management is an organization that will rapidly outcompete its peers. When getting into ESG in particular, we recommend using the following model of continuous improvement2:

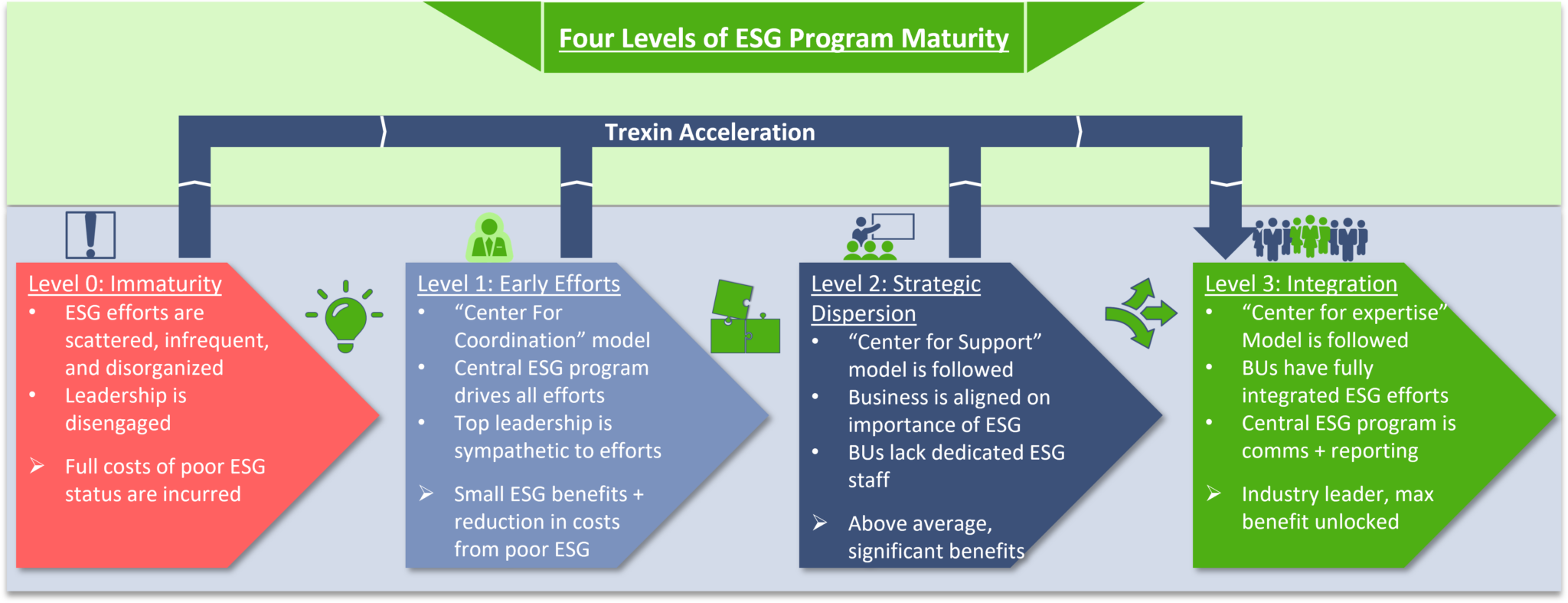

In order to reach a state of organizational success where continuous improvement occurs, a company must transform their business to an organizational structure that can support it. As businesses continue to enhance their ESG capabilities, they often move through four distinct organizational maturity phases3:

0. Immaturity: This stage is essentially the null-state. The company’s ESG efforts are scattered, disorganized, and infrequent if they exist at all. Leadership is highly disengaged from any ESG programs, and rarely if ever offers any form of support to them. Typically, at this stage a company is incurring costs due to their poor ESG status.

1. Early Efforts: Put simply, this stage is where true progress begins to be made on adopting ESG efforts into the organization. The company has begun creating a formal ESG program, and the program typically serves as a Center for Coordination, driving, coordinating, and owning all ESG efforts across the company as well as communicating them to leadership and/or outside parties. At this stage it is also common for overall ESG performance to begin to be tracked. Unfortunately, individual stakeholders throughout the organization are somewhat disengaged from these efforts and leadership would at best be described as sympathetic to ESG efforts. At this stage a company will significantly reduce costs caused by poor ESG status; however, it may not have fully eliminated them and is unlikely to have unlocked significant benefit yet.

2. Strategic Dispersion: Once a company has reached this stage, they are generally above average performers from an ESG perspective. The company will typically follow a Center for Support model with its ESG program. The program will operate as a central team with smaller groups imbedded in business units. Business units lack dedicated ESG staff in many cases and rely on the main ESG program to provide these. Additionally, despite now valuing ESG efforts stakeholders will oftentimes not consider ESG efforts to be outside of their scope of responsibility and instead the main ESG program will be responsible for ensuring the business unit strategy and ESG goals remain aligned. However, on the flip side, leadership is starting to champion ESG and overall values it highly. At this stage the company will also begin reaping significant benefits from its ESG efforts.

3. Integration: This is the goal of a company’s ESG program maturity journey, and companies which reach this point are typically industry leaders. The company’s ESG program generally acts as a Center for Expertise with the ESG program primarily used for communications and reporting, along with occasionally providing specialized expertise when it is required for projects and initiatives. Stakeholders across the company view ESG a primary strategic goal and work to drive initiatives themselves. Thus, the business units only rarely draw resources from the ESG program as dedicated teams are no longer required in most circumstances except to provide high-level strategy or specialized functions. Finally, at this stage the company reaches a state of continuous improvement, and maximum benefit is unlocked.

When left to grow organically, an ESG program typically reaches these four phases in sequential order, increasing the amount of business transformation required as prior moves become redundant, and increasing the time until maximum benefit starts being unlocked. However, there is no hard fast rule that this must be the case, with a dedicated team of experts it is possible to create a highly mature ESG program quicker and easier, often skipping the intermediate levels. If you are interested in kickstarting your organization’s ESG journey, please reach out to us at Trexin.

REFERENCES

- Mankins, Michael, and Dan Schwartz. “Building Your Own High-Performance Organization.” Bain, Bain & Company, 14 Aug. 2018, https://www.bain.com/insights/building-your-own-high-performance-organization/.

- Papadopoulos, Kosmas, and Rodolfo Araujo. “The Seven Sins of ESG Management.” The Harvard Law School Forum on Corporate Governance, Harvard University, 23 Sept. 2020, https://corpgov.law.harvard.edu/2020/09/23/the-seven-sins-of-esg-management/.

- Cuellar, Marjolein, et al. “Six Pitfalls To Avoid When Mobilizing For Sustainability.” BCG Global, BCG, 11 Apr. 2022, https://www.bcg.com/publications/2022/six-pitfalls-to-avoid-when-mobilizing-for-sustainability.