Insight Paper December 17, 2018

Change Management Thrives in the Financial Regulatory Space

The right process methodology can steer you into a strong regulatory future.

The regulatory landscape continues to play a major role in a financial institution’s ability to adapt, innovate, and survive in the competitive financial technology and banking markets. With the increasing demand for technology systems to deal with compliance streamlining and reporting standards required by oversight and supervisory entities, change management has a strategic role in placing the critical people, assets, and rules in place to succeed in managing existing and new regulatory environments and rules. An organization must have the capacity and willingness to bear the financial and human capital toll required to enact change strategies to alleviate new regulatory hardships. In order to achieve the results desired, companies can deploy several change methods to combat the weaponized alterations embedded within fresh regulations or historical legal continuity standards. As Trexin highlighted in late 2017, “In the wake of the Great Recession and other well-publicized failures of corporate governance, it is no surprise that financial services companies are more highly regulated: Congress and other regulatory bodies enacted extensive ‘control oriented’ legislation in response to these problems.”[1]

First, an organization must enact a proper regulatory change management program. This encompasses not only recruiting internal change management professionals but also granting them certain powers to have influence over cultural and workforce aspects of the company. These professionals will also sit close to leadership personnel granting them the tools (data, personnel, and software access, etc.) necessary to manage or execute a change response. A change matrix must be formed which directly outlines relationships and correlations between internal change professionals and who they report or delegate the executions of that change to. For example, if a change manager embeds themselves with a senior director of investor relations, they may record points of contact when 10-K filings cross through before being finalized. We can create a flowchart in Visio observing the path of a 10-K document. Who begins authoring the filing? What department heads see it before publication? What office or individual approves before submission? Now, imagine that a new regulation comes across the desk of financial institutions where they require additional information in the 10-K. The organization employs their internal change teams to manage how the new requirements have been handled and recommend procedures of efficiency. Notice they do not directly dictate the path of how to deal with this change, the change managers simply provide recommendations.

Second, in addition to your internal team, excessively large and heavy changes to a company’s infrastructure will require hiring outside sources. External change management consultants provide immensely valuable services, especially from a competitive angle. Trexin’s consultants have been deployed to numerous financial services institutions from insurance to wealth management where the final deliverable involved streamlining and adapting systems and people to new regulatory change. However, the change consultants can only be effective if they are granted internal insight, access to stakeholders, and the necessary knowledge to research company activities. This may involve interviewing employees or viewing sensitive historical company records. This component requires trust first and foremost, a hallmark of the Trexin slogan – Trust, Experience, and Innovation.

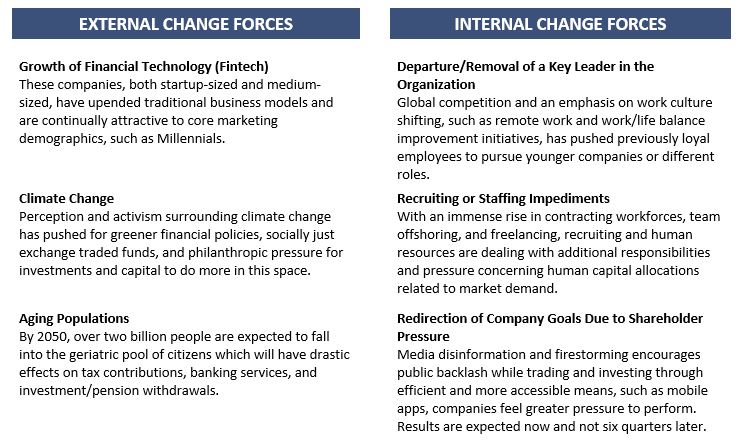

Here are some internal vs. external examples of change in action:

In 2018, Deloitte remarked, “While we expect some greater clarity about the regulatory outlook to emerge in 2018, the overriding challenge for firms remains coping with uncertainty, including from the global impacts of Brexit and how markets in Europe and elsewhere will be reshaped by Markets in Financial Instruments Directive (MiFID) II. This will put a premium on firms maintaining strategic flexibility, while they also adopt new technologies to react to the threat from ‘challengers,’ improve their customer service and outcomes, better manage their risks, and help control costs.”[1] Regardless of the health of the market or the predicted certainty of consumer spending, financial services will remain adamantly effected by continuous change and pressure, largely stemming from economic globalization and increased uncertainty in geopolitical protectionism and trade disputes.

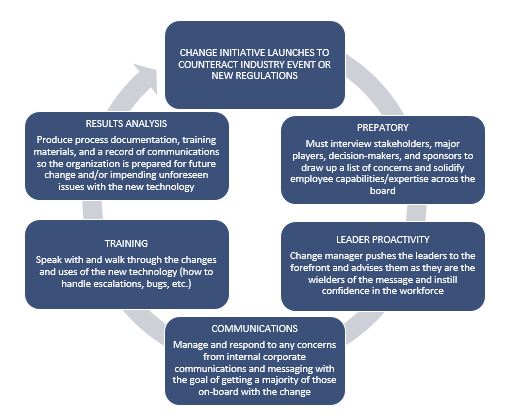

In addition to the above internal and external changes that may drastically influence financial institutions, we can identify five major components of change management that both prepare and assist companies in dealing with or prospering during strenuous change-required environments. These “User-Adoption Steps” are recommended to follow before implementing the necessary change. For these examples, as highlighted in our previous Trexin insight, we are discussing the deployment of a new software system to manage and streamline regulatory compliance standards that have been strengthened or enacted by the public sector. Our goal is to successfully deploy this technology efficiently and within reasonable financial benchmarking. By bringing in external change management consultants, we will do it right the first time (and pay more) so we don’t have to reap the financial and resource catastrophe years later if implemented poorly.

BUSINESS ALIGNMENT[2]

Success in adopting to new technology depends as much on following clear objectives and plans as it does on deploying the technology itself. To ensure that executives and senior management agree on the strategic objectives of the implementation, User Adoption Services help you achieve the following:

- Align executives and senior management around clear project objectives

- Create a change strategy for the project

- Define business and performance metrics

- Develop an activation plan for performance, training, communication, and reinforcement strategies

TRAINING

With the implementation of new technology, users need to be prepared to use it efficiently and effectively. Educating users is therefore a critical component in achieving your strategic objectives. User Adoption Services help you do the following to develop your employees’ competencies:

- Assess training requirements

- Prepare executives and managers to help direct reports effectively and efficiently execute daily activities

- Provide job-role and process-oriented training to managers and end users

- Prepare support teams to help all users

- Validate acquired knowledge and skills

- Key users and managers from the business who are part of the implementation team and need to provide business and business process information to the technical project team members

COMMUNICATION

How well do your employees understand why new technology is necessary and how it will affect their daily jobs? User Adoption Services focus on planning and providing information before, during, and after the project launch to do the following:

- Raise awareness about the change in technology and process

- Deliver a consistent key message

- Inform the affected target audiences

- Manage and overcome resistance

PERFORMANCE AND MEASUREMENT

Clearly defined metrics are crucial to managing the progress and gauging the success of a technology implementation. User Adoption Services help you do the following to ensure that you can track and validate your implementation:

- Translate the company strategy into measurable and achievable objectives for each department and job role

- Define leading and lagging key performance indicators that enable measurement of strategic objectives

- Support the implementation team in designing required reports

- Optimize and review management processes to measure performance

REINFORCEMENT

The biggest challenge after launching new technology is obtaining sustainable results and integrating long-term changes into your organization. Different types of support—all focusing on enabling users to adapt to change and integrate it in their daily routines—are available with User Adoption Services to do the following:

- Develop and execute short-term support (such as onsite assistance, help desks, coaching, and communication)

- Create and deliver ongoing communication messages

- Develop and execute long-term support (such as online help, center of excellence, new-hire training, and reinforcement communication and training)

Implementing new technologies, especially with the growing presence of AI and machine learning within financial institutions, is not only about the numbers and engineering behind the tech. Companies have a responsibility to understand and protect their labor force as well. In the regulatory environment, these technologies also have the potential to reshape many activities across compliance and reporting activities, leading to significant productivity gains. While there’s a lot of talk about how automation technologies will create new roles with exciting opportunities, the most powerful impact will be on the data quality and the efficiency with which manual tasks will be accomplished.[3] A change manager must prepare for these significant, even short-term, environmental workforce factors that may alter an employee’s role and responsibility. By interviewing stakeholders and reviewing established process documents, the change manager can identify areas of impact that an industry shift, such as automation, may have within the division of a company. Automation promises to be a game-changer for regulatory affairs, decreasing the cost of data management and improving data quality to allow regulatory experts to focus on where they truly add value. Repetitive and routine manual tasks in regulatory processes can be automated and tackled in a very sophisticated and seamless way. Automation can play a key role in decreasing the manual effort in document management, data collection, data management, data quality improvements, and in preparation for data exchange with agencies (SPOR in EU and SPL in US).[4]

Correctly implemented change initiatives and endeavors can have long-lasting effects on the stability and competitiveness of a financial institution. Effective change management can reduce the delivery risks of implementing intelligent automation technologies such as analytics, machine learning, and Robotics Process Automation.[5] Before managing the change that is affecting your business, remember the following high-level dynamic process to smooth the transition:

All the processes and rules suggested in this piece are ineffective without the motivated leadership and a serious desire to wants to manage and effectively handle change. Rapidly progressive technologies and an incalculably large subset of utilizing big data are pushing even strong and well-entrenched companies to adapt quicker and sooner. It is essential that financial institutions and their leadership are aware and ready to take on immediate and long-term change strategies. This strategy, known sometimes as maintaining sustainability, is the lifeblood that keeps organizations from failing to compete. Stagnation is one of the greatest threats to change and financial institutions have a responsibility to their customers, employees, and the strong economic foundation of our country to enroll in transformation culture. A workforce that is prepared and enthusiastic about enacting change and striking down repetitive, monotonous tasks in favor of strong value-added work will be the most influential organizations moving steadily into the 21st century of traditional banking, fintech, and high finance.

References

[1] Trexin, Navigating New Regulatory Waters

[2] Deloitte, US-Regulatory Banking Outlook 2018, 4

[3] https://education.oracle.com/user-adoption-services

[4] https://www.arisglobal.com/regulatory-affairs-automation-greatest-regulatory-challenges/

[5] https://www.arisglobal.com/regulatory-affairs-automation-greatest-regulatory-challenges/

[6] https://financialservicesblog.accenture.com/the-need-for-change-management