Insight Paper January 28, 2025

Winning the IDR Battle: The Optimal Offer Strategy Through the Plan/Issuer Lens

Understanding the Independent Dispute Resolution (IDR) Process and the No Surprises Act.

The No Surprises Act was enacted to protect patients from unexpected medical bills, often referred to as “surprise billing.” These bills typically occur when patients receive care from out-of-network providers, even though they sought care at in-network facilities. To address disputes over payment amounts between healthcare providers and insurers, the law established the Independent Dispute Resolution (IDR) process. This arbitration system determines a fair payment amount, benchmarked against the Qualifying Payment Amount (QPA), which reflects the median in-network rate for a specific service in a given region.

The IDR process aims to balance costs between providers and insurers while fostering fairness and transparency in the healthcare payment system.

WHAT IS THE QPA AND HOW IS IT CALCULATED?

The Qualifying Payment Amount (QPA) serves as the benchmark for determining fair payment in the IDR process. It represents the median contracted rate for a specific service in a geographic region, calculated as follows:

- Identify the Relevant Contracted Rates:

– Collect all contracted rates between the insurer and in-network providers for the specific service and region as of January 31, 2019. - Adjust for Inflation:

– Apply the Consumer Price Index for All Urban Consumers (CPI-U) to update the 2019 rates to reflect current values. - Calculate the Median:

– Identify the median contracted rate for the service in the region. If there is an even number of rates, the QPA is the average of the two middle values. - Apply to Similar Services:

– When rates are unavailable for a specific service, insurers may use rates for comparable services as a proxy, ensuring consistency and fairness.

A robust QPA calculation relies on comprehensive, accurate data and adherence to regulatory guidelines. Arbitrators often view a well-calculated QPA as a baseline for determining fair payment.

INSIGHTS FROM THE IDR DATA ANALYSIS

The IDR data for 2023 has been publicly published by the Centers for Medicare & Medicaid Services (CMS). Analyzing the 2023 data set on disputes reveals an interesting and counterintuitive trend on how much a plan/issuer should offer in the IDR process. Central to the process is the determination of a fair payment amount, frequently benchmarked against the QPA. Therefore, the 2023 offers as a ratio of the QPA is an ideal way to analyze the outcome of different offers.

RETHINKING THE QPA OFFER FACTOR FOR PLANS/ISSUERS

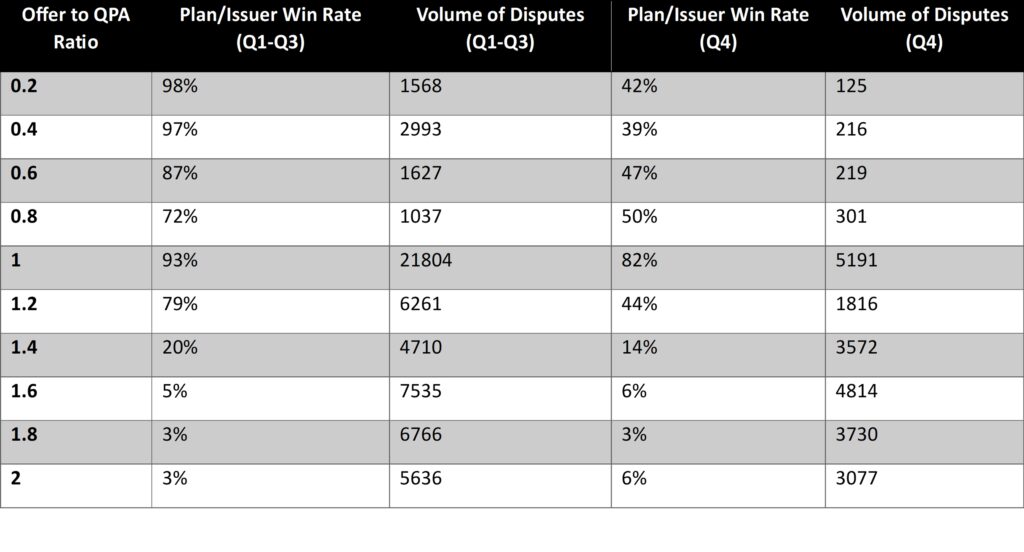

Historically, payer offers around 1.0 times the QPA rate resulted in the highest number of favorable outcomes for plans/issuers as seen in the QPA and Offer Table below. Offers closely aligned with the QPA were perceived as reasonable and fair by arbitrators, increasing the likelihood of success for the payer’s offer.

However, recent court rulings (Texas Medical Association (TMA) I-IV) have shifted this dynamic. Arbitrators must now weigh additional factors beyond the QPA, such as:

- The provider’s level of experience and training.

- Market rates for similar services.

- Patient acuity and complexity of care.

This broader approach challenges the previous strategy of strictly aligning offers with the QPA. To succeed in this evolving environment, plans/issuers must now adjust their strategies and justify offers using a more comprehensive set of data.

The 2023 CMS data, summarized in the table below, underscores these changes. For instance, offers at a 1.0 QPA ratio had a plan/issuer win rate of 93% during Q1-Q3 but dropped to 82% in Q4. Similarly, offers at higher QPA ratios, such as 1.2 or above, saw even more significant declines in win rates, indicating that the reliance on a fixed QPA ratio is no longer as effective as it once was. The data also shows a notable volume of disputes across different QPA ratios, reflecting the shifting strategies and arbitration outcomes. These trends are expected to evolve further in response to the new legal requirements, highlighting the need for ongoing analysis of the 2024 data when available.

QPA and Offer Table:

Offer as a Factor of the QPA and Associated Win Rates for Plans/Issuers (CMS 2023 Data)

IMPORTANCE OF ADAPTING TO COURT RULINGS

The rulings in Texas Medical Association (TMA) I-IV have expanded the criteria arbitrators use to evaluate fair payment offers. While the QPA remains a crucial benchmark, plans/issuers must adjust their strategies to account for the following additional considerations:

- Provider Expertise: The training, experience, and quality of care provided by the out-of-network provider.

- Regional Market Rates: Evidence of what providers in the same area charge for similar services.

- Patient Complexity: The specific circumstances of the patient’s care, including acuity and additional resources required.

As a result, the previous strategy of consistently offering at a 1:1 ratio to the QPA may no longer yield the best outcomes. Plans/issuers must adapt by analyzing these additional factors and incorporating them into their offers. The trends observed in the 2023 data strongly indicate that these shifts are already impacting win rates, particularly in Q4. Further analysis of the 2024 data will be essential to refine these strategies as the IDR process continues to evolve.

STRATEGY RECOMMENDATIONS FOR PLANS/ISSUERS

- Reassess Offer Anchoring

– Avoid defaulting to a 1:1 ratio of offer to QPA. Instead, tailor offers based on provider expertise, regional market conditions, and patient complexity to align with the broader criteria arbitrators now consider. - Enhance QPA Calculations

– Use comprehensive market data to develop accurate and defensible QPAs.

– Regularly review and update QPAs to reflect the most current market trends.

– Maintain transparent documentation of the QPA calculation process. - Incorporate Additional Data Points

– Collect and analyze data on market rates, provider qualifications, and care complexity to justify offers effectively. - Monitor Trends in Arbitrator Decisions

– Continuously evaluate IDR outcomes to refine strategies and identify shifts in decision-making patterns. - Prepare for Increased Scrutiny

– Ensure consistency in offers across similar cases and anticipate detailed reviews of justifications for any deviations.

CONCLUSION

The IDR process under the No Surprises Act continues to evolve, shaped by both CMS guidance and significant court rulings. While the QPA remains an important reference point, recent rulings necessitate a more nuanced approach. Plans/issuers must move beyond a singular focus on the QPA and incorporate broader criteria into their strategies. By adapting to these changes, leveraging comprehensive data, and refining offer methodologies, plans and issuers can improve their outcomes in the evolving IDR landscape. Further analysis of the 2024 IDR data will provide additional insights to guide these strategies.

As the IDR landscape continues to shift, now is the time to revisit and refine your offer approach. The success of the 1:1 offer to QPA ratio may continue to decline as we have seen it start to do so. Use this insight to continuously test where the optimal QPA ratio is falling to stay ahead of the curve and be ready to adapt as new data and regulatory changes emerge in 2025. Stay tuned for an update regarding the 2024 data once released!